- #donaldtrump

- #joebiden

- #community

- #israel

- #supremecourt

- #ukraine

- #media

- #election2024

- #gaza

- #abortion

- #arizona

- #elections

- #openthread

- #election

- #republicans

- #scotus

- #russia

- #democrats

- #law

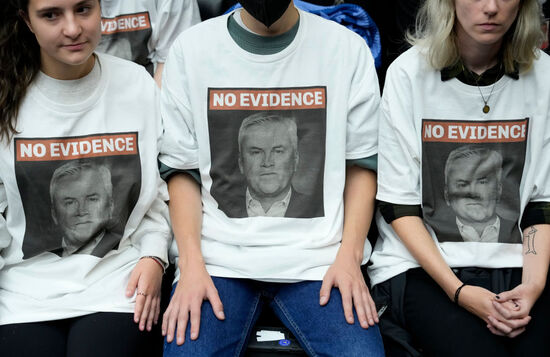

- #davidpecker

- #education

- #climate

- #culture

- #trumptrial

- #dailykoselections

- #2024

- #cartoon

- #presidentialimmunity

- #healthcare

- #pennsylvania

All Recent Stories

Staff

Community

Trending

Elections

From Markos' Desk

Comics

Community Groups

Community Spotlight

Actions

Civiqs

Make a Donation

© Kos Media, LLC. Site content may be used for any purpose without explicit permission unless otherwise specified. "Kos" and "Daily Kos" are registered trademarks of Kos Media, LLC.